A View From the Tower

What A Quarter!

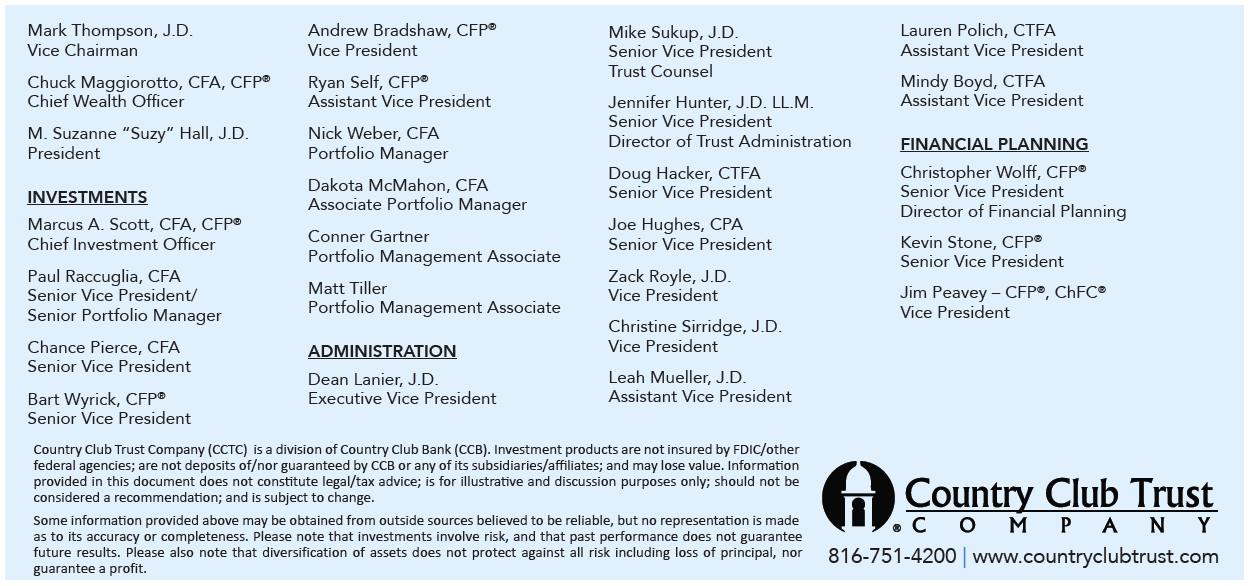

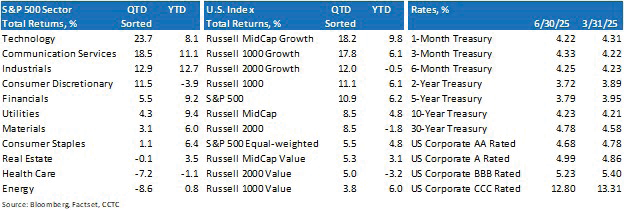

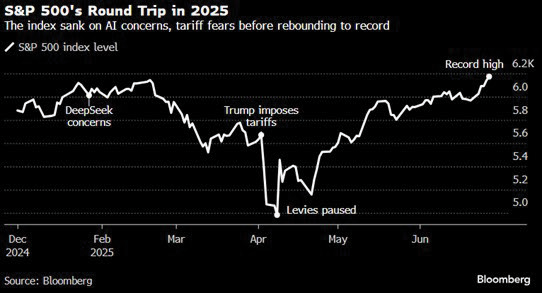

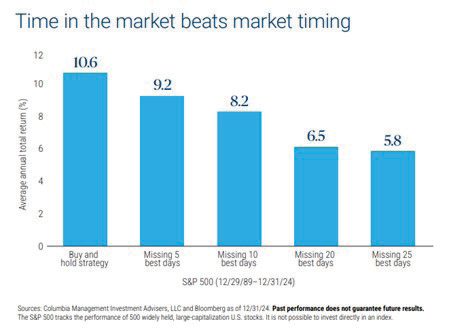

We typically comment in this publication, and indeed do this quarter as well, that “we genuinely believe that time in the market is key, as attempting to time the market is a fool’s errand.” Well, the second quarter is quite an example of this. If one was omniscient enough to inform you on April 1 (No Fools!) that there would be fear of an all-out global trade war post “Liberation Day”; a contentious budget bill process (“One Big Beautiful Bill”); DOGE (The Department of Government Efficiency) angst; an additional credit agency downgrading United States debt below AAA; uneasiness, to say the least, in the Middle East due to Israeli conflicts on two fronts; and the United States bombing Iran’s nuclear enrichment sites, I am not sure any of us would have predicted a S&P 500 return of nearly 11%. And that’s what occurred as it took just fifty-five trading days for it to roundtrip from its closing low on April 8 to an all-time high on June 30; the fastest bounce back in seventy-five years.

Source: Money Markets, LLC

With trade and broader President Trump 2.0 policies, particularly on the tariff front, producing mixed messages, uncertain potential economic outcomes and growth fears during the first quarter, the result was the S&P 500 having its worst quarter since the third quarter of 2022. However, whether one has the opinion, depending on your own political position, that President Trump is either a master negotiator or the manifestation of the “TACO” environment (“Trump Always Chickens Out”), over the course of the quarter these concerns seemed to subside, at least for the time being, as numerous declarations occurred, and the markets showed their resilience.

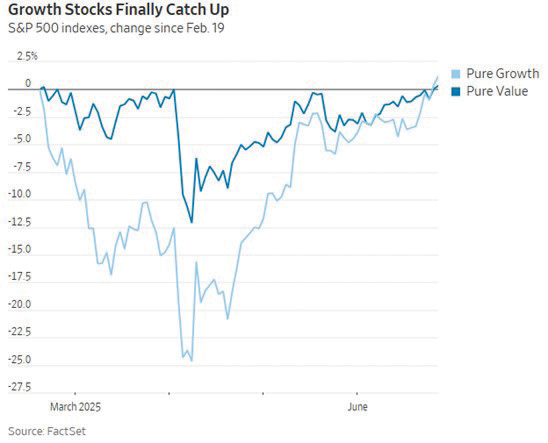

Notably, the highly publicized “Magnificent Seven”, which was a laggard during the first quarter, returned to stardom during the second, as the Russell 1000 Growth Index, which these stocks dominate, rose by nearly 18% (not a typo) while its counterpart, the Russell 1000 Value Index increased by just short of 4%. Meanwhile, international stocks continued to post strong returns as the MSCI All Country World Index, excluding the United States, rose by over 12% as a weak dollar and their lower valuation levels in general provided a tailwind. Arguments that the United States exceptionalism narrative was over still surfaced, but only time will tell.

Source: WSJ

Not to be left out, the broad bond market extended its first quarter rally as the Barclays Intermediate Government/Credit index posted a 1.7% return on top of its 2.4% gain over the first three months of the year.

But Wait,…..There’s More……

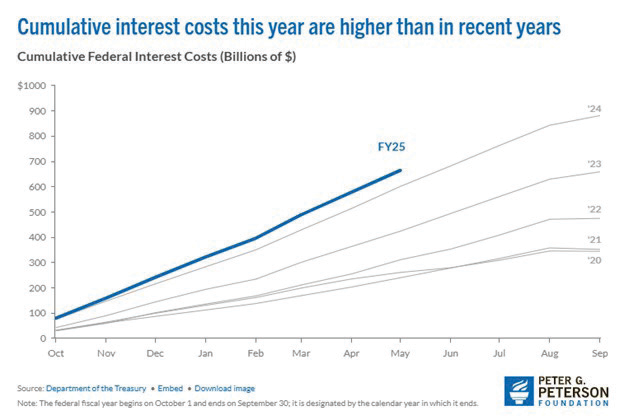

Certainly, one could opine that the list above would provide more than enough news and potential economic facets for digestion, but as the old “infomercials” were prone to state, “but, wait, there’s more”. Not to be overlooked was the ongoing drama between President Trump and Federal Reserve Chairman Powell. As has been well publicized, the President would like “The Fed” to cut interest rates significantly as inflation has calmed; with the level of interest expense on the growing national debt directly impacted by its rate posture. The President would also like to promote economic growth. Mr. Powell on the other hand, along with some of his committee members, is more concerned about the potential impact of tariffs on inflation; a point of considerable debate. The result, ongoing criticism of Mr. Powell by the President, along with multiple comments about his firing (whether or not it is even possible), along with his potential replacement when his Chairmanship term expires in May of 2026. Among other statements, the President has commented that he is considering using the next Federal Reserve Board of Governors vacancy in early 2026 to appoint Mr. Powell’s eventual successor. Some potential high drama to say the least.

What Will the Federal Reserve Do?

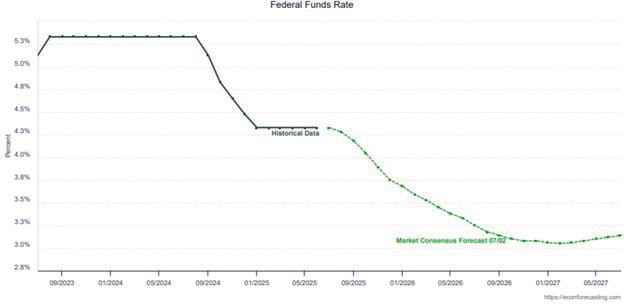

Aside from all the theatrics, eyes remain on the Federal Reserve and what its moves will be during the second half of 2025. As most may recall, estimates by Fed followers, and by the Fed itself, have not always hit the mark. With the risk of being misguided again, The Fed has continued to project two quarter point rate cuts during the remainder of 2025, with the first possibly occurring in July, but more likely September. Additionally, it should be noted that Quantitative Tightening (QT) has been significantly adjusted as the Committee continues to reduce its fixed income holdings.

All this being said, the Fed has remained relatively coy concerning guidance on what comes next as it digests ongoing data and remains “well positioned to wait” as monetary policy remains “modestly restrictive” with a need for a greater confidence level that inflation is sustainably moving toward the Fed’s 2% target, in light of its “dual mandate” of maximum employment and stable prices. This being said, at this point, some would speculate that economic growth may be more of an issue than inflation related risks, although as alluded to above, the jury is still somewhat out in regard to tariffs.

As Usual, the U.S. Consumer Looms Large

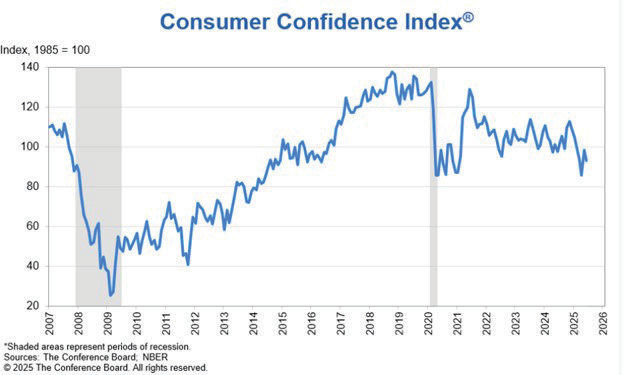

As we have mentioned previously, consumers play a pivotal role in the U.S. economy as their spending accounts for approximately 70% of the Gross Domestic Product (GDP). When consumers are confident and consequently tend to spend more, businesses thrive, leading to job creation and economic growth. Conversely, when consumer spending declines, it can lead to economic slowdowns or even recessions. Related survey data throughout 2025 has seemed to reflect a somewhat cautious turn for not only consumers, but also businesses.

With doubts regarding the condition of the consumer in mind, the odds of a U.S. recession trended higher during the first part of the year, but have recently subsided. While there is always a chance of recession in any one year (typically 15%) many economic prognosticators have their chances of recession over the next twelve months in the 35% neighborhood currently as U.S. real (GDP) growth forecasts have been impacted by actions taken in anticipation of tariffs; in an effort to avoid or at least mitigate them.

One additional dynamic in this regard is the potential loosening of federal regulations on multiple fronts. Although not necessarily highlighted to date, the administration has taken a variety of steps, in a range of industries, to theoretically reduce such governmental “burdens”.

What Now?!

As all of us have been told many times, likely more than we have actually listened to and embodied, patience is a virtue. It’s not always easy admittedly, particularly in an environment of divisiveness. However, as we have often stated, our portfolios are managed with both your risk tolerance and return objective in mind. And as mentioned above, we genuinely believe that time in the market is key, as attempting to time the market is a fool’s errand. In our view, compounding returns of high-quality portfolios is key towards achieving your financial goals.

All of us at Country Club Trust Company, along with the entire Country Club Bank organization, hope that you and your families are well. Please be assured that we continue to work diligently on your behalf, providing the level of service you have come to expect and deserve. As always, we are ready and willing to be of assistance in any way we can. Should you have any questions, we are always here for you.

Take care.